One of the requirements for Settlement permit is a secure livelihood. You can find out in detail in this article when exactly your livelihood is considered secure by the German authorities.

It is not easy to answer exactly how much you need to earn, as the respective authority carries out an individual assessment for each foreigner. How much money you need to have available each month to receive a Settlement permit depends on many different factors: for example, how many people are in your family, whether you are married, the age of your children and how much you pay in rent. You can find a simple calculation example at the end of this blog article.

You are also welcome to use our free test to find out whether you meet all the requirements of Settlement permit .

a) Principle: Secured means of subsistence, in accordance with Section 9 (2) No. 2 AufenthG

aa) General definitions

A foreigner's means of subsistence (= standard requirement + rental costs + health insurance cover) is secured in accordance with Section 2 (3) AufenthG if they can provide for themselves and their own family (community of need) from their own regular income without recourse to public funds[1].

Standard requirement within the meaning of § 20 I S. 1 SGB II:

- z. e.g. clothing

- Foodstuffs

- Household articles

- Electricity ...

The examination of whether subsistence is ensured(Section 9 (2) no. 2 AufenthG) is based on the provisions of SGB II, which is why the need must be determined according to the social law rules on the community of need. [ 2]

In principle, the decisive factor is whether the subsistence of the community of need as a whole is secured.[3]

There must be no entitlement to public funds (under SGB II).

Excursus on the community of needs:

- A community of need also exists in the case of "marriages without a marriage certificate" or patchwork families

- Pure flat-sharing communities are not a community of needs!

- In the case of people who are not (or no longer) able to work, the household community is not to be taken into account, but only the individual![4]

- Children of full age are included in the community of need as long as they are not economically independent.

- persons not yet of legal age are also taken into account if they are economically independent [5]

- When children reach the age of 25 or get married, they should generally be considered separately [6]

- Maintenance obligations of the adult child towards the parents are not taken into account to the detriment of the child[7]

- German family members are not to be taken into account

- Foreign family members who are required to leave the country are included in the community of need[8]

bb) Need according to the standard rates of SGB II

The needs used to calculate your living expenses are therefore based on the standard rates of § 20 SGB II/§ 27a, 28 SGB XII.

You can find an overview of the current level of the standard rates here.

Pursuant to Section 2 (3) AufenthG, the receipt of public funds does not constitute the receipt of:

- Child benefit

- Child supplement

- Parental allowance

- Parental allowance

- Training assistance benefits in accordance with the Third Book of the German Social Security Code, the Federal Training Assistance Act and the Upgrading Training Assistance Act,

- Public funds that are based on contributions or that are granted to enable residence in the federal territory and

- Benefits under the Maintenance Advance Act.

Housing benefit [9] & care allowance [10] in accordance with § 37 SGB IX are not included in the calculation of the means of subsistence, but do not preclude the assumption of a "secure means of subsistence".

bb) Forecast decision of the authority

As a rule, a negative certificate from the social welfare authorities is nevertheless not sufficient to prove that the person is able to support themselves.

The Foreigners' office carries out its own calculation of requirements

- Estimate for the future (also based on retrospective consideration)[12]

- "What is required is a positive prognosis that the foreigner's livelihood will be secured in the long term without recourse to other public funds. This requires a comparison of the anticipated need for maintenance with the resources available in the long term."[13]

- "Consideration of career opportunities, employment history and current income situation" + "Reliability of the inflow of funds"[14]

- in the case of fluctuating monthly amounts, an average value of the last 6 months is usually calculated[15]

- Tips can be taken into account if they are customary in the industry[16]

- Income from a second employment relationship that can only be earned in violation of the maximum working time of 48 hours/week(Section 3 ArbZG) should not be taken into account as it is not sustainable[17]

(P): "too" favorable rent:

- "If the rent is very cheap and it is therefore unlikely that the accommodation will be available permanently, it should be possible to fall back on the rent appropriate to the location."[18]

(P): Use free of charge:

- It is assumed that the transfer of use free of charge is only temporary and the costs actually incurred by the main tenant or owner are recognized[19]

(P): Home ownership:

- The monthly burden from the loans + housing benefit is used for the calculation

We enforce your rights!

b) Privileges for foreigners with refugee status

aa) Predominantly secured, Section 26 (3) sentence 1 no. 3 AufenthG

- Better position compared to § 9 II 1 No. 2[20]

- A predominant means of subsistence exists if at least 51% of needs, including health insurance cover, can be met without recourse to public funds[21].

- This is the case as long as the total income from gainful employment outweighs the state benefits claimed[22]

bb) largely secured, Section 26 (3) sentence 3 no. 4 AufenthG

- "Securing a livelihood for the most part as required by Section 26 III sentence 2 AufenthG exists if the available income from own resources covers significantly more than half of the needs, but the livelihood cannot be fully covered without recourse to public funds." ... "In order to do justice to the intention of the legislator, a much stricter standard must be applied to the "predominant means of subsistence" than for the predominant means of subsistence; in these cases, the legislator demands a clear "more" than for the predominant means of subsistence.

- The undefined legal term "largely predominant" cannot be defined with an exact percentage, but must be interpreted taking into account the specific circumstances of the case and the above-mentioned intention of the law. A guideline value of 75 - 80 % of the calculated need can be used as a point of reference."[23]

- "When the livelihood is "predominantly" secured cannot be precisely derived from the law. However, it can be assumed that this is the case if the ratio of earned income to state benefits is more favorable than 3:1"[24]

- This phrase should also not completely exclude the receipt of social benefits, but requires more extensive own income of the foreigner than para 3 sentence 1 no. 3[25].

c) Exception pursuant to Section 9 (2) sentence 6 AufenthG in conjunction with sentence 3. S. 3

In the case of physical, mental or psychological illness or disability, the provision of subsistence (no. 2) is not required.

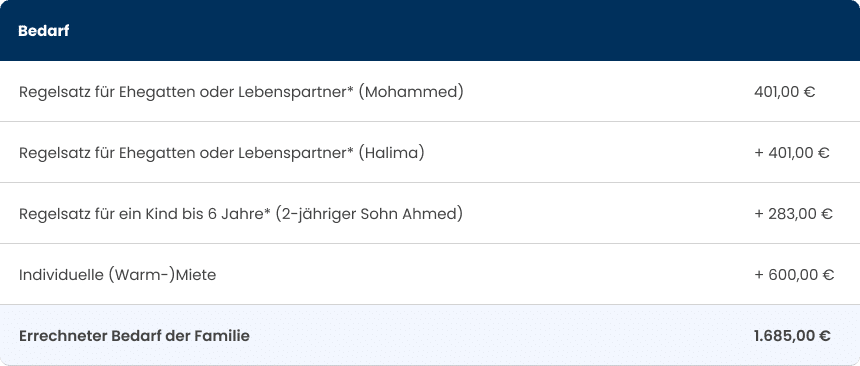

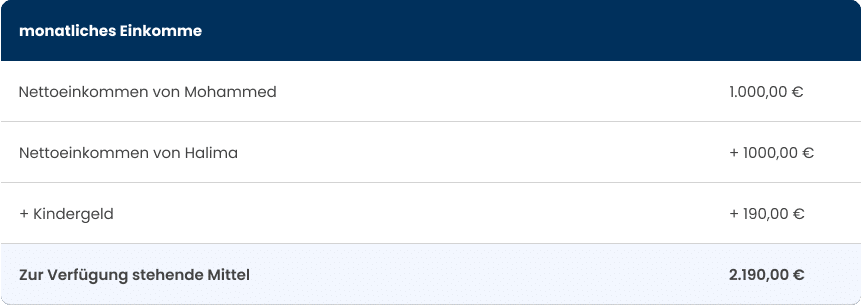

e) Example of securing a livelihood

aa) Principle

In order to obtain a Settlement permit , you must prove, among other things, that you can support yourself or your family (= standard requirements according to SGB II + rent + health insurance contributions) independently (without state support from social welfare or Hartz 4). The receipt of benefits within the meaning of Section 2 (3) AufenthG, such as child benefit, parental allowance or BaföG, is irrelevant!

So exactly how much you have to earn depends on how many people are in your family, whether you are married, how old your children are, how much your rent is...

The following is a simplified illustration with exemplary figures:

Example: Mohammed + Halima + son Ahmed (2 years old)

*To understand where the values for the standard rates come from, have a look at this table on Wikipedia .

The livelihood according to § 9 para. 2 no. 2 AufenthG is secured here!

(This means that with their monthly income of €190, Mohammed and Halima can cover their minimum subsistence needs of €1,685, calculated according to statutory standard rates).

bb) Special regulation for refugees

If you are in possession of a residence permit that identifies you as a refugee within the meaning of Section 25 (1) sentence 1 alternative of the Residence Act, you have 2 options for obtaining a Settlement permit :

(1) in accordance with § 26 para. 3 sentence 1 after 5 years

For this, your family's livelihood must be predominantly secured.

This means that more than half of the money you need to live on must come from your own income. However, you may also receive social benefits.

In our example (see above), Mohammed and his wife would have to earn at least € 843 per month together, regardless of the shares. This corresponds to slightly more than half of their total monthly need according to the Social Code. Mohammed and Halima can receive the remaining amount required to meet the family's calculated living expenses (in this case € 842) from the state without this being a problem for the issue of the Settlement permit .

(50 % of € 1,685 = € 842.50)

(2) in accordance with § 26 para. 3 sentence 3 after 3 years

In order to be able to obtain a Settlement permit as a refugee after 3 years, you must finance your living expenses largely from your own resources.

This means that at least 75% of the costs for food, housing and everyday necessities must be covered by your own employment. However, complete independence from social benefits is not necessary here either.

If we apply this to our examplefamily (Mohammed + Halima; see above), the law requires a calculated total requirement of 1.685 €that Mohammed and his wife together have a total monthly income of at least around 1.265 € at their disposal. Whether this money is earned by Mohammed and Halima together or by Mohammed alone, for example, is irrelevant. The family may receive a small amount of social benefits on the side without this being detrimental to the granting of the Settlement permit .

(75 % of 1.685 € = 1263,75 €)

Do you still have questions?

Summary

As you can see, the calculation of secured living expenses is very complex and depends on the individual case. We have only been able to give you a small excerpt of the various regulations here.

Still not sure whether you meet all the requirements of Settlement permit ?

Simply take our free test!

Sources:

[1] https://www.bamf.de/DE/Themen/MigrationAufenthalt/ZuwandererDrittstaaten/Migrathek/Niederlassen/niederlassen-node.html

[2] BVerwG NVwZ-RR 2012, 333.

[3] BVerwG, decision of 16.8.2011 -1 C 4.10 - NVwZ-RR 2012, 333, para. 14.

[4] BVerwG, 18.04.2013, 10 C 10.12, para. 19

[5] VAB* 2.3.1.5

[6] VAB 2.3.1.5.

[7] BVerwG, 28.09.2004, 1 C 10.03.

[8] BVerwG 08.04.2015, 1 B 15.15.

[9] BVerwG, 29.11.2012, 10 C 5.12; previously already Nds. OVG, 20.03.2012, 8 LC 277/10, see also VAB 2.3.2.6.1

[10] BeckOK AuslR/Maor, 27th ed. 1.10.2020, Residence Act Section 9 marginal no. 12a.

[11] Renner/Bergmann/Dienelt, § 2 para. 15.

[12] Bergmann/Dienelt, 13th ed. 2020, Residence Act Section 9 para. 38.

[13] BVerwG; 26.08.2008, 1 C 32.07; BVerwG 29.11.2012, 10 C 4.12, para. 25.

[14] No. 2.3.3 VV-AufenthG; BVerwG, 07.04 2009, 1 C 17.08, para. 33; OVG BBg, 13.04.2010, OVG 11 S 12.10.

[15] VAB 2.3.1.9.

[16] VAB 2.3.1.10.

[17] VG Berlin, 29.09.2011, 33 V 106.08.

[18] OVG Berlin-Brandenburg, 14.04.2010, OVG 11 S 12.10.

[19] e.g. VAB 2.3.1.8.

[20] Bergmann/Dienelt/Röcker, 13th ed. 2020, Residence Act Section 26 para. 28.

[21] BeckOK AuslR/Maaßen/Kluth, 27th ed. 1.10.2020, Residence Act Section 26 para. 16a.

[22] Bergmann/Dienelt/Röcker, 13th ed. 2020, Residence Act Section 26 para. 28.

[23] State authorities, decision of 29.09.2017 - 14.21 - 12230/1-8 (§ 26) - asyl.net: M25534

[24] BeckOK AuslR/Maaßen/Kluth, 27th ed. 1.10.2020, Residence Act § 26 marginal no. 16b.

[25] Bergmann/Dienelt/Röcker, 13th ed. 2020, Residence Act Section 26 para. 33.